Banks and pulp & paper

The pulp and paper industry has a negative impact on nature, climate, and frontline communities all over the world, while also contributing significantly to deforestation, which increases the risk of new pandemics. Paper accounts for between 33 and 40% of all industrial wood traded globally. In many cases, the pulp and paper supply chains are not traceable throughout the industry, increasing the risk that the raw materials and products used and sold are linked to deforestation, climate emissions, and human rights violations. To tackle these four emergencies, banks must act urgently and decisively to address the impacts linked to their financing of the pulp and paper sector.

As one of the largest industrial sectors in the world, the pulp and paper industry has an enormous impact on global forests. Because paper production begins with forest management and wood harvesting, the pulp and paper industry contributes significantly to deforestation. Irresponsible harvesting of natural forests for the establishment of pulp plantations can endanger fragile ecosystems and species while also causing soil erosion. Some proposed new pulp plantations endanger natural habitats in High Conservation Value areas with high rates of illegal logging. For example, the remaining natural forests and wildlife species in Borneo and Sumatra, Papua New Guinea, and Brazil's Atlantic forest region, among many others, are all threatened by rising demand for pulpwood. Furthermore, toxic chemicals such as chlorine are used in papermaking to break down wood pulp and bleach paper. These hazardous chemicals' byproducts have an impact on the environment as well as on the industry workers, particularly when they are discharged into nearby water supplies and land.

Forests play a vital role in the global carbon cycle. When forests are cleared or burned, the carbon that has been stored in them is released into the atmosphere. Furthermore, the majority of greenhouse gases released in pulp and paper manufacturing are from the energy used to power the mills. Indonesian pulp and paper products produced on drained peatland landscapes have one of the world's largest carbon footprints. According to research into the life cycle carbon footprint of pulp and paper mills in the United States, fuels account for 50% of total GHG emissions, electricity 24%, wood procurement 10%, transportation 10%, and chemicals 6%. Moreover, paper mills frequently fail to meet the highest possible standards for clean production, and the process of manufacturing paper emits nitrogen dioxide, sulphur dioxide, and carbon dioxide, contributing to pollution such as acid rain and accelerated global warming.

Communities all over the world have lost and continue to lose their lands and forests due to existing plantations and plantation expansion; basic human rights are being violated. Asia Pulp and Paper (APP), Indonesia's largest paper producer, for example, has "hundreds of conflicts" with communities in five Indonesian provinces. According to Human Rights Watch, APP is also complicit in a number of human rights violations, including the intimidation, harassment, and assault of local residents who oppose its operations.

There is an increasing body of evidence linking deforestation to an increased risk of disease outbreaks and pandemics. The destruction of forest ecosystems contributes significantly to the emergence and spread of diseases. According to the Union of Concerned Scientists, wood products, including paper, account for about 10% of total global deforestation.

Role of banks

Banks play a role in continuing to finance the pulp and paper industry, thereby contributing to negative impacts on climate, nature, human rights, and the risk of future pandemics. Financiers of pulp and paper mills are co-responsible with the pulp companies for ensuring that these negative impacts are avoided. Prevention of such impacts is in the interest of financial institutions because destructive projects also pose a serious financial risk: illegal activity, social conflict and environmental harm directly impact on the profitability of projects and can cost both pulp companies and their financiers dearly in reputation and market share.

In 2021, the top 10 financial institutions collectively provided over US$3.6 billion to the pulp and paper sector, with Barclays, Mizuho Financial Group and Bank Central Asia ranking first, second, and third, respectively. The top clients of these banks are Sinar Mas Group, Marubeni and Oji Group.

What banks must do

A financial institution considering finance for the pulp and paper sector should have investment policies for the sector in place that state clearly that it will only provide financial services to companies whose production, sourcing or selling activities meet stringent environmental and social safeguards as set out in our report Green Paper, Red Lines.

We demand from banks that they:

-

Support activities in line with the EPN Global Paper Vision, such as efficiency and recycled pulp mills;

-

Ensure the legality of all production activities and complete compliance with all local, national, and international norms, regulations, laws, and conventions pertaining to the entire production and value chain;

-

Require all clients to publicly disclose a full and comprehensive Environmental and Social Impact Assessment covering all direct and indirect impacts of all forest and manufacturing activities and operations;

-

Require all clients to commit to a policy of No Deforestation, No Expansion on Peat and No Exploitation (NDPE).

-

Require all clients to demonstrate that proposed operations have obtained the free, prior, and informed consent (FPIC) of all affected Indigenous peoples and communities with customary rights, as defined in the UN Declaration on the Rights of Indigenous Peoples (UNDRIP), as well as traditional rights, such as land tenure and use rights of local communities.

-

Demonstrate that they do not finance, directly or indirectly, the operations of their clients or the companies from which they source materials for their manufacturing process that are extractive, industrial, environmentally and/or socially harmful, as defined by the No Go Policy.

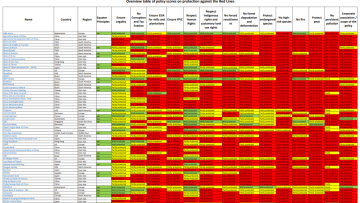

In early 2020, the Environmental Paper Network (EPN), of which BankTrack is a member, evaluated the investment policies of 68 major financiers of the pulp and paper industry. They benchmarked the policies against 14 absolute minimum criteria that all financial institutions should require their clients, investments, and business partners to adhere to in order to preserve forests and protect the environment, respect human rights and safeguard the interests of communities. These criteria are fully described in the Green Paper, Red Lines report, which is a translation of EPN’s Global Paper Vision for use by financiers. You can see how financial institutions scored in the table below.

Overview of bank policy scores 'In the Red' report

This table lists banks that have adopted each criterion fully ( ), partially ( ), or that have not adopted ( ). Click on 'Details' for the rationale of this assessment for each bank.